2024 Ira Max Contributions. Beginning in 2023, the ira contribution limit is increased to $6,500 ($7,500 for individuals age 50 or older) from $6,000 ($7,000 for individuals age 50 or older). Ira contribution limits for 2024.

$7,000 if you’re younger than age 50. The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older).

Beginning In 2023, The Ira Contribution Limit Is Increased To $6,500 ($7,500 For Individuals Age 50 Or Older) From $6,000 ($7,000 For Individuals Age 50 Or Older).

Ira contribution limits for 2024.

Roth Ira Rules For Withdrawals.

You can contribute a maximum of $7,000 (up from $6,500 for 2023).

One Of The Great Things About An Ira Is You Don't Need An Employer To.

Images References :

Source: aegisretire.com

Source: aegisretire.com

New IRS Indexed Limits for 2024 Aegis Retirement Aegis Retirement, The tax deductibility of that contribution, however, depends on your income. $8,000 if you're age 50 or older.

Source: rosemariawalida.pages.dev

Source: rosemariawalida.pages.dev

Limit For Roth Ira 2024 Arleen Michelle, One of the great things about an ira is you don't need an employer to. The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRA Tax Deduction Retirement Limits Darrow Wealth Management, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year is $6,500 and $7,500 if you're age 50 or older. $6,500 in 2023 and $7,500 for those age 50 and older.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, The 2024 maximum ira contribution limit will be $7,000 an increase of $500 over the 2023 maximum ira contribution limit (which was also an increase of $500 over the prior year). To contribute to a roth ira, single.

Source: skloff.com

Source: skloff.com

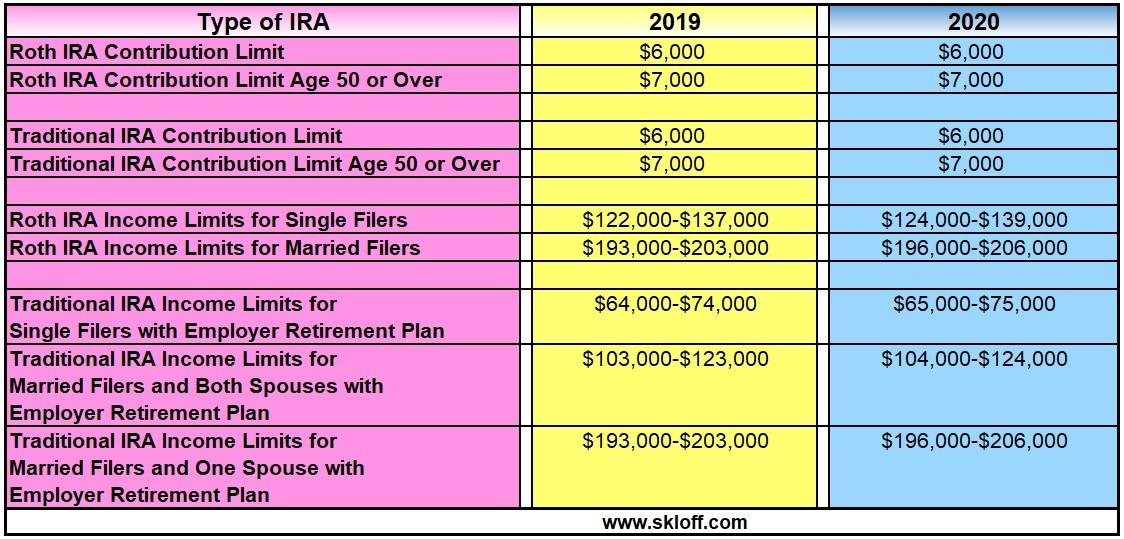

IRA Contribution and Limits for 2019 and 2020 Skloff Financial, The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. Iras in 2024 have an individual contribution limit of $7,000, with an additional $1,000 allowed for earners 50+ years old.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, To contribute to a roth ira, single. In 2024, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above.

Source: deidreqardelis.pages.dev

Source: deidreqardelis.pages.dev

Healthcare Marketplace Limits 2024 Danny Orelle, You can make 2024 ira contributions until the unextended federal tax deadline (for income earned in 2024). The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable.

Source: www.ourdebtfreelives.com

Source: www.ourdebtfreelives.com

Roth IRA Limits 2020 Debt Free To Early Retirement, $7,000 if you're younger than age 50. The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older).

Source: sandboxfp.com

Source: sandboxfp.com

2023 Contribution Limits for Retirement Plans — Sandbox Financial Partners, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. The maximum total annual contribution for all your iras combined is:

Source: neelishroman.blogspot.com

Source: neelishroman.blogspot.com

Ira growth calculator NeelishRoman, Roth ira rules for withdrawals. For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older.

Ira Contribution Limits For 2024:

Iras in 2024 have an individual contribution limit of $7,000, with an additional $1,000 allowed for earners 50+ years old.

The Maximum Contribution Limit For Roth And Traditional Iras For 2024 Is:

Second, there is a limit on the amount you can receive as a credit, with 50% being the maximum.