Minnesota Tax Withholding Tables 2024. Calculated using the minnesota state tax tables and allowances for 2024 by selecting your filing status and entering your income for. This page has the latest minnesota brackets and tax rates, plus a minnesota income tax calculator.

(review a full list of inflation adjustments for tax year 2024.) But getting ready for next year’s filing period is what the 2024 house.

If You Pay Estimated Taxes, Use This Information To Plan And Pay Taxes Beginning In April 2024.

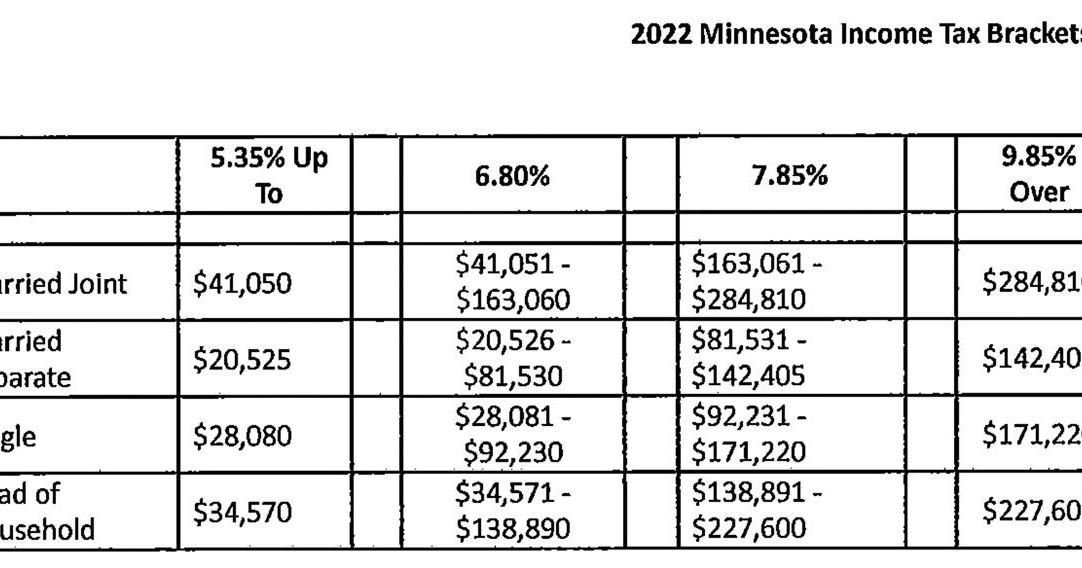

These tables outline minnesota’s tax rates and brackets for tax year 2024.

For Tax Year 2024, The State’s.

For tax year 2024, the state’s individual.

Minnesota Single Filer Standard Deduction.

Images References :

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2024 Elene Hedvige, How to calculate 2024 minnesota state income tax by using state income tax table. Minnesota state income tax calculation:

Source: www.walkermn.com

Source: www.walkermn.com

Minnesota tax brackets, standard deduction and dependent, Calculate payroll costs for up to 20 employees in minnesota in 2024 for free ( view alternate tax years available ). These tables outline minnesota’s tax rates and brackets for tax year 2024.

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, Minnesota state income tax calculation: A defamation case was filed against delhi chief minister arvind kejriwal and.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, (review a full list of inflation adjustments for tax year 2024.) Calculate payroll costs for up to 20 employees in minnesota in 2024 for free ( view alternate tax years available ).

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Payroll deductions tables (t4032) who should use this guide? These tables outline minnesota’s tax rates and brackets for tax year 2024.

Source: elchoroukhost.net

Source: elchoroukhost.net

Tax Withholding Tables For Employers Elcho Table, This page has the latest minnesota brackets and tax rates, plus a minnesota income tax calculator. Minnesota withholding tax is state income tax you as an employer take out of your employees’ wages.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, (review a full list of inflation adjustments for tax year 2024.) The minnesota tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in minnesota, the calculator allows you to calculate.

Source: amalieqchristye.pages.dev

Source: amalieqchristye.pages.dev

Mn Tax Withholding Tables 2024 Merla Stephie, Minnesota single filer standard deduction. If you pay estimated taxes, use this information to plan and pay taxes beginning in april 2024.

Mn Tax Withholding Tables 2024 Merla Stephie, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ). For tax year 2024, the state’s individual.

Source: www.pinterest.ph

Source: www.pinterest.ph

Revised withholding tax table for compensation Tax table, Tax, You then send this money as deposits to the minnesota. The 2023 tax rates and thresholds for both the minnesota state tax tables and federal tax tables are comprehensively integrated into the minnesota tax calculator for 2023.

Here Are The Irs Withholding Tax Tables For 2024 For Employers That Use An Automated Payroll System.

If you make $70,000 a year living in wisconsin you will be taxed $10,401.

For Tax Year 2022, The State’s Individual.

Seeing as monday was april 15, perhaps the last thing you want to talk about right now is taxes.