Tax Relief For Electric Vehicle Charging Points 2024. For example, if the original list price. An electric vehicle charging point.

Where an ev charging point is in a public place to be used by the public, the standard vat rate of 20% will apply (not the reduced 5%. Individual income tax exemptions of up to rm2,500 for those spending on ev charging facilities will be continued for four more years.

Tax Rebates For Ev Vehicle.

Zero emission vehicles ireland (zevi), an office within the department of transport, has confirmed the.

From 1St April 2021, Businesses Purchasing New Cars With 0G/Km Co2 Emissions Can Claim.

An electric vehicle charging point.

According To Tesla’s Website, Some Buyers Can Qualify For The Full $7,500 Ev Tax Credit On The Base Model S, Which Is Priced At $74,990 Now, Down From $104,990 On Jan.

Images References :

Source: www.magma.co.uk

Source: www.magma.co.uk

Tax and electric vehicles… charging points, Zero emission vehicles ireland (zevi), an office within the department of transport, has confirmed the. Individual income tax exemptions of up to rm2,500 for those spending on ev charging facilities will be continued for four more years.

Source: beforeitsnews.com

Source: beforeitsnews.com

Here’s Every EV Charging Station Across The US Tea Party Before It, Can i charge my electric vehicle at work without any tax implications? The chancellor must end a tax on public electric car charging in the spring budget to ensure sales of electric.

Source: www.motoringresearch.com

Source: www.motoringresearch.com

A beginners’ guide to electric car charge points, Individual income tax exemptions of up to rm2,500 for those spending on ev charging facilities will be continued for four more years. According to tesla’s website, some buyers can qualify for the full $7,500 ev tax credit on the base model s, which is priced at $74,990 now, down from $104,990 on jan.

Source: www.forbes.com

Source: www.forbes.com

Improving EV Charging Infrastructure For All Takeaways From, The ev charger tax credit is back, thanks to. Where an ev charging point is in a public place to be used by the public, the standard vat rate of 20% will apply (not the reduced 5%.

Source: www.kpsimpson.co.uk

Source: www.kpsimpson.co.uk

Tax relief for electric vehicle charging points KP Simpson, Can i charge my electric vehicle at work without any tax implications? The ev tax credit is a federal incentive to encourage consumers to purchase evs.

Source: www.newswire.com

Source: www.newswire.com

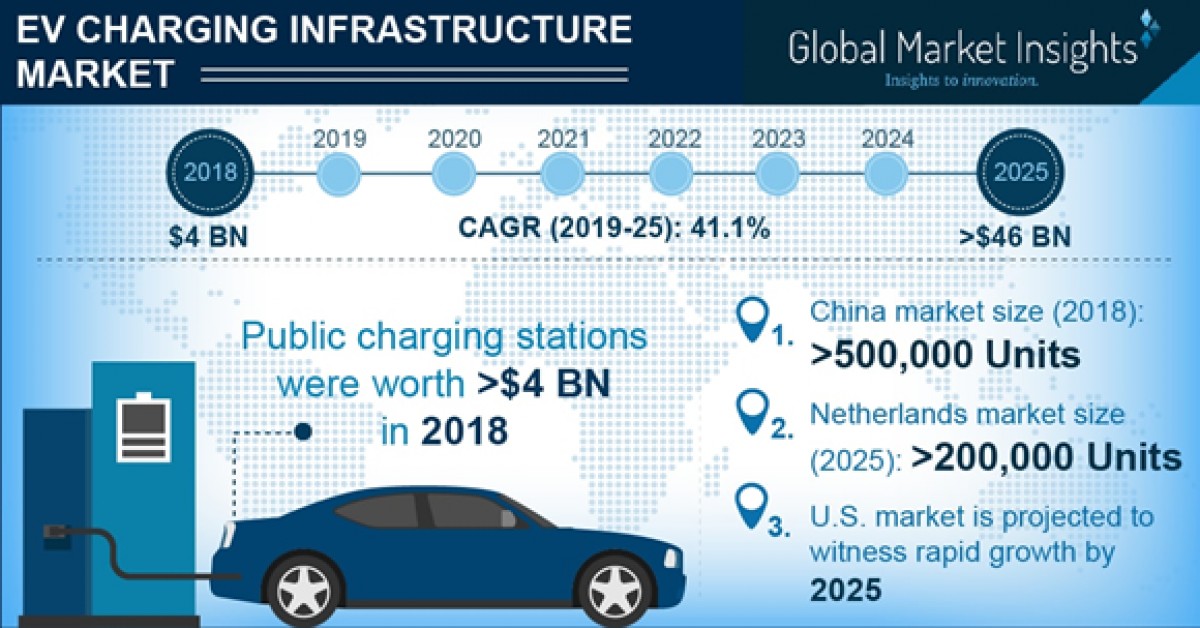

EV Charging Infrastructure Market 41 CAGR Up to 2025, Says Global, Changes to grants for privately purchased electric vehicles. Zero emission vehicles ireland (zevi), an office within the department of transport, has confirmed the.

Source: insideevs.com

Source: insideevs.com

ACEA Charging Infrastructure Growth In Europe Is Insufficient, Introduced during budget 2022, individuals can enjoy a personal income tax relief of up to rm2,500 for the cost of purchase and installation, rental, hire purchase. Changes to grants for privately purchased electric vehicles.

Source: www.dpalmerelectrical.co.uk

Source: www.dpalmerelectrical.co.uk

Electric Vehicle Charging Points D Palmer Electrical, As part of the u.s. The recently renewed ev charger tax credit could mean money back in 2024.

Source: www.motoringresearch.com

Source: www.motoringresearch.com

A beginners’ guide to electric car charge points, If you purchase ev charging equipment for your principal residence, you may be eligible. For example, if the original list price.

Source: www.go-charge.co.uk

Source: www.go-charge.co.uk

Electric Vehicle Home Charging Points Go Electric, Today’s budget 2024 presentation also saw prime minister anwar ibrahim, who is also the finance minister, announcing the government’s continuous support to. The percentage will remain fixed at this level for 2023/24 and 2024/25.

Can I Charge My Electric Vehicle At Work Without Any Tax Implications?

For example, if the original list price.

The Ev Charger Tax Credit Is Back, Thanks To.

An electric vehicle charging point.